Leaderboard

Popular Content

Showing content with the highest reputation on 13/03/26 in all areas

-

Theer are visionaries who join Parties with teh hope of making a difference, but the first thing that they learn is that politics is a game of compromise.A person might have the idea to brighten a room by turning on the light with a switch, but then has to compromise on wiring, switch design, lumen output and positioning.5 points

-

I've only got 12klm to drive to vote, but fairly safe from wombat and roo hazards. The biggest hazard is when you get to the polling centre and our dickhead local member tries to grab your hand to shake it.3 points

-

lt's just a real shame in this country there's no true visionary anywhere to vote for. A true leader with real vision real ideals, to fix what needs fixing and set us up in a brilliant direction , to truly look after their people and country and hold everything we have here dear. There's no one, hasn't been since ld even know. Hawk maybe could've been such a special leader on the surface , not sure how he went though. Hanson at least has very very strong ideals, to at least point our country to somewhere but ofc she'd also be scary as hell at the helm too in most other ways, Aus wouldn't risk it and l'm not saying l think they should- just before anyone jumps all over that one. My only point is that there's never one truly special, made for the job once in a lifetime someone that's dreamt of the job their whole lives for the right reasons and visions bc of what they want for for our country and people. There's no one, never is, such a shame. Most of the Majors are just politicians, people that just seem to end up falling into the job, like Angus has, Lee. All the other leaders on both often just end up getting voted in bc they have no one else at the time. l think Albo had some sort of real vision but we see where that's landed but he's never been a truly talented leader though anyway.3 points

-

Scottish Company Stuck With 10,000 Bottles of “Minge Repellent” After Catastrophic Typo A small Scottish outdoor products company has found itself in a rather awkward situation this week after a printing error left them with 10,000 bottles of insect spray labelled “Minge Repellent” instead of “Midge Repellent.” The product, intended to protect walkers, campers, and anyone foolish enough to stand still in the Highlands for more than three seconds from midge attacks, was due to launch this spring as “the most powerful midge repellent in Scotland.” Unfortunately, somewhere between the design team and the printing press, was one unfortunate letter mistakenly inserted. The result? Shelves full of bottles claiming to repel something entirely different. Company founder Dougie MacRae addressed the situation at a press conference yesterday, “Look, we want to make this absolutely clear. These bottles do not repel minges. They repel midges, which are sometimes far worse in most parts of Scotland. Believe me using the spray will not have any impact on your ability to get your leg over." MacRae explained that correcting the mistake would cost thousands in reprinting and relabelling, which for a new company could be catastrophic, so the company is now appealing directly to the Scottish public. “Please understand,” he continued, holding up a bottle while visibly trying not to laugh, “this is still one of the best midge repellents on the market today. The spelling mistake does not affect the formula in any way.” Early reactions online suggest the error may actually boost sales. Several outdoor shops have already reported customers pre ordering multiple bottles “for the laugh,” while one Highland camping store reportedly sold out of future orders within an hour after posting the label on social media.3 points

-

I haven't voted for the last four Fed elections, just paid the fines, because the major parties are more internationalist than Australian these days, I can't stomach them. But if a One Nation candidate is contesting in my electorate, I'll consider voting again, give them the top spot and place the major parties last and second last. Other than that, I'll just keep paying the fine.2 points

-

Shipping costs and disruptions, both air and sea, are the hidden costs of this American bombing expedition. It's going to have a major impact worldwide. Not to mention the number of people curtailing their holidays because of airspace and airport closures. A lot of people have forgotten that Russian airspace is already closed to all civilian aircraft, and that is impacting air freight and passenger movement and costs. Doha, Dubai, and Bahrain are big transport hubs and are currently closed, so flights are being diverted all over the place. Oman is presently reasonably secure, but that could change. Here's the latest news on air freight shipping. The news is not good for drugs and pharmaceuticals moving from India to Europe, they are forecasting major shortages in Europe, shortly. https://www.freightwaves.com/news/air-cargo-shippers-scramble-to-mitigate-iran-war-impacts I was a bit nervous as regards a new tractor crankshaft I'd ordered from Czechia, but ended up surprised at how the shipping cost was still reasonable, and the transit time was fast. The crankshaft is made in Germany, but it was shipped from Tuchomerice, Czechia (from Vaclav Havel Prague airport) on the 10th March (Tuesday) - from there it went to Koeln in Germany, thence to Shenzhen in China, then on to Singapore early yesterday morning. It landed in Perth early this morning, and they say it will be delivered this afternoon. Can't complain about that service! The crankshaft is big and heavy and weighs 47 kgs, and it cost me US$185 in freight cost, just under AU$260. I acquired the crankshaft for less than half the cost that local suppliers charge, including the airfreight cost. The total cost was AU$950.2 points

-

That is a matter of opinion, I own my own home and I wouldn't have it any other way. That is a self centered comment.2 points

-

2 points

-

2 points

-

2 points

-

Why compare us to Europe, People compare the price of petrol in Europe to Australia price when we say its to expensive here. You can catch a train from Amsterdam to Vilnius for 60 euro. Not much is the same. We should be able to afford houses. I have 2 kids looking and both can't afford and they get pretty upset about it. The ball has really been dropped the ball on this one.2 points

-

I can understand why young people are turning away from the major parties. Over time Australia has become a country where a whole generation of young Australians will never be able to own their own home. It doesn't matter how hard they work and save, it gets them nowhere. A lot of people make excuses and give various reasons why the country is like that, but the fact remains that it degenerated to this under the stewardship of one of the major parties or the other. Whether or not they are totally to blame, they have that job and the buck has to stop with them and they carry some responsibility for letting it happen.2 points

-

Yep! He's a slimy bastard. And I'm not saying that simply because of teh Party he is in. He's puolled some pretty shonky deals in his life.1 point

-

Russians furious as Putin cuts off internet: 'I started to panic' Throughout modern history, regimes seeking to maintain power have often targeted communication networks, limiting access to news, social media or mobile connectivity during times of political tension or security threats. Such measures are typically justified as necessary for national security. Critics, however, argue that restricting communication infrastructure can also make it easier for authorities to control public discourse and reduce the ability of citizens to organize Kremlin cites security The Kremlin says recent mobile internet disruptions in Russia were introduced for security reasons. Kremlin spokesman Dmitry Peskov said the restrictions comply with existing legislation and were necessary to ensure public safety. or share information. “All disconnections and restrictions on communication are carried out in strict accordance with current legislation,” Peskov said. The comments came after residents in Moscow, St. Petersburg and other Russian cities reported widespread mobile internet outages. Networks disrupted Users first began reporting problems accessing websites and mobile applications in Moscow on March 5, according to the Russian technology outlet Kod Durova. In some cases, people said they lost service entirely and were unable to make phone calls. The disruptions affected Russia’s four largest telecom operators — MTS, Megafon, Beeline and T2 — though the outages appeared inconsistent depending on location.1 point

-

Not only that sort of person. Anyone with with the ability to do something that a lot of people need done from time to time will have work thrust on them. Have you ever tried to get a plumber or electrician at short notice?1 point

-

1 point

-

1 point

-

I've explained it before. The nearest polling booth and PO mailing box are 37km from my place. I won't travel that distance without being compensated for fuel, wear and tear, and lunch money. 74km total on rough bush roads dodging roos, wombats, and potholes. No thanks ... But for One Nation I might, because they have Traditional Aussies needs high on their list of considerations.1 point

-

According to the report it crashed in Western Iraq Iraq shares its Eastern border with Iran The Yanks will know its exact location from the flight log and GPS apart from other sophsiticated equipment on board. Iran would have to send its troops in to Iraq & there is no love lost between the 2 countries. They fought an 8 year long war starting in 1980 along their different religious beliefs. Most Iraqis are Sunni Moslems & Iran is Shia.1 point

-

The Victorian guy who won the $50,000,000 last night did so on a four-game self marked ticket that cost him $6.50. Smaller than a mini quickpick. I only take a mini quickpick (6 games), when the jackpot is greater than $10million. I've won a few small prizes, but as they say, win a bit, lose more.1 point

-

Of Course you have to be in it to win it. Mostly only poor people gamble on them. Nev1 point

-

I was Comfortable in it. 10'7 squares in the old formula. Lot's better than the Tiny bungalow I had prior. Nev1 point

-

It will sell if the Price is right.. It's about 3x the size of the first house I had Built with Just a carport. The street was Gravel with no formed gutters. 1/4 acre block though. That was the standard then 1972. Nev1 point

-

1 point

-

1 point

-

I think she will be getting a lot of the protest vote about the quality of the 2 major party's and they have no one to blame but themselves. Have a look at some of the videos of the senate estimates. are they really that stupid that they don't realise social media makes how the act in parliament accessible to the masses now days. It use to be that you would only get 30 seconds on nightly news.1 point

-

1 point

-

1 point

-

Minge repellant. It's either a send up, or someone did it on purpose. And when did "repellant" become "repellent". More Americanisms sneaking into the Queens English??1 point

-

Yes I did see that this morning. Thankfully I am no longer a developer, but also coming up to retirement, anyway. I had a catch up with a friend of mine who is a developer and he is very concerned. They are required to use Claude (https://claude.com/), whichis a specialist software development platform. If they don't ring upa big enough biill in Claude, they are considered underproductive and not adept to change, and the door will be shown to them. Hi is absoltely gobsmacked at how far the paid for version has come. He can literally do in minutes what was done in days. And itis all highquality code and consider the edge cases without being prompted. We concluded that there will be far, far fewer, but higher quality developers managing the delivery by prompt. I have said for a while now that AI has hit critical mass and jobs are going to go.. Software development is a clear one. As are solicitors and even barristers (not baristas, though), accountants, even financial engineers (quants) are going to find it hard going. Project management, etc.. It is all Not to mention interviews are becoming more grulling as the questions are created by AI. Development interviws give you an AI set and a timelimit and you have to build a fully functioning app in the technology stack using the AI tools within an hour. I have said it before and will say it again.. Unlike other labour disruption technologies in whhich people could redeploy, AI will replace without the redeploy option for most.1 point

-

Quite so. But mainly so because our PM and party are playing nice in the sand pit. But just look at the Trump fiasco and you can see how a ruthless mob can tilt the playing field with disasterous consequences. We rely on the politicians obeying the checks and balances built into the system. So far that's worked. The yanks had checks and balances, but they stopped playing by the rules and it ceased being 'by the people, of the people or for the people'.1 point

-

He actually said people would watch PORN.. It would have permitted surgery to be Performed remotely and bring us to a First world system of Fast Fibre-optic Connectivity.. What an outright CRETIN. Nev1 point

-

For generations in Europe People can NEVER own their Own home and cope with it fine. Because of John Howard's Push for Investment in Houses, which are Not productive, we now have Overcapitalised and Have some of the Biggest Houses in the entire world. IT did Not have to be that way. Steps are being taken that will gradually change that but if it Happened quickly it would not be the desired effect without consequences. Nev1 point

-

I well remember Abbott saying this: "Abbott claimed that the vast majority of Australians did not need, nor want to pay for, the high-speed fibre network proposed by Labor, suggesting it was simply a tool to allow people to watch movies." In 2020 during Covid fast internet was the saviour of the economy and many, many workers, including me. Today, many people work either full or partially from home, freeing up roads and public transportation and improving people's working lives.1 point

-

The Constitution and the major parties are in question now because of their excessive international stance on everything. Australia has become a poor second. Islam seems to be an important priority for some strange reason. Traditional Aussie bushies view it as laughable, but serious, and we're coming closer together.1 point

-

Hopefully they won't blink and will finish what they started. Getting rid of the regime is the only way to provide any hope of it not happening again. The've kicked the can down the road for years and deluded themselves that you can negotiate with terrroists. The regime has been taking the mickey out of the west for years. Putin uses similar tactics, dangle the hope of negotiations and a settlement in front of suckers to string them along so you can evenntually get your own way. There's still a lot of mugs calling for negotiations; I just don't know when they'll realise you can't talk to people like that.1 point

-

Pete, I haven't read the constitution in a long time but from memory it was designed the way you describe, representation by elected members rather than a party system. I don't think there's much in it at all about parties. Most of what we do in parliament is by convention and not by constitutional rule. As an example, there's nothing in the constitution to stop the Labor party winning an election and nominating Angus Taylor as PM. A lot of the constitution is about day to day rules for pollies.1 point

-

True words indeed. As OME pointed out, we rely on a majority party to be in power, and a minority party in opposition 'to keep the barstewards honest'. By definition that is a government divided. Dispense with the party and party leaders. The PM can be chosen by a majority vote from the floor. As Nev points out, we are heading toward a one party system. This is not a good path either. In theory, when a party decides a policy, it should be voted by secret ballot in a caucus meeting. But I think there is bullying going on in this process. I do not believe it is really democratic. If a policy is good, then both parties would approve and if the process was transparent, the electorate would see the reasoning behind it. At present clear policy information is not freely accessible, unless we really dig for it. Have you read the official party websites? They all sound the same, with all the right vague catchwords.1 point

-

Antony Green in his election blog has listed the seats he thinks ON would have a chance based on the three-candidate preferred result in 2025. It doesn't appear to give them any seats, but he said if they poll 25% at the next election they will sweep up seats all across regional and rural Australia, mainly at the expense of the Nats and Libs. The Farrer byelection will be a big one for them. Some polls have them leading the primary vote but the preferences will make it hard for them. If they do win it, it will have a big momentum value for ON. https://antonygreen.com.au/one-nations-poll-surge-the-first-25-seats-to-watch/1 point

-

In Queensland the Labor government brought about the abolition of the upper house in 1922 because it was blocking their legislation. One of the Labor MPs went on to be Lieutenant-Governor, then appointed fifteen Labor people to the upper house who then had a majority to vote to disband it. The problem is, once it's gone, no government wants to have it back as they have a free run for passing legislation if they have a majority government. On the bright side, if numbers are close between government and opposition, the government members will make sure they show up to parliament. Sometimes if one is crook and can't be there for a crucial vote they will do a pair arrangement. On the subject of the LNP amalgamation in Queensland, it's the opposite of what a federal amalgamation would look like. In Queensland, the Nationals were always the bigger party of the two and even governed alone without the Libs for six years. One aspect of the amalgamation was to do away with three cornered contests. With the federal Libs being the much bigger party, I doubt the federal Nats would be too keen on amalgamation. I think Pauline and Co. would be happy to see a federal amalgamated LNP as it would possibly deliver them a bigger slice of the vote on the right.1 point

-

Since the major parties always win government, and have done since 1901, why not just let them alternate every three years. Imagine the money we'd save by not having elections, and all the political fighting would disappear, relieving all the stress of wondering if they'll win government. Each of the majors only need to wait three years and they'd be back in again. Good idea? What do you think of it?1 point

-

The Party determines policies, not the Leader. The party also selects and removes a Leader. It's a team deal with Party Members involved. A Government divided unto itself shall surely FAIL,UNLESS THE Leader becomes a Dictator Like Putin or Trump (or a Theocracy like IRAN) and all hope is gone. Trumps agents are now Pushing the Concept that God installed Trump to do his Divine work. What hope have WE got??? Nev1 point

-

Without a political party, the elected individuals are not distracted by leadership struggles. The members all read the proposals instead of their leader interpreting it for them. Then they vote on the issue. A bonus is that the financial backing gets more difficult for the vested influences.1 point

-

The background gossip says that Trumpy has long wanted USA to take over Karg Island. He first mentioned this many years ago. So far that oil loading island has not been touched by USA or Israel. Control of that island would control most of china's imported oil supply. And incidentally might be worth billions of $.1 point

-

I think the way things are at the moment, the powers that be in Iran would know the first two or three might get hit. It would make sense to stick a couple of fall guys in initially. Expendables, so to speak.1 point

-

Like the facebook link that goes to a fake ABC Insiders site. It shows the ABC on Pauline's side well and truly. We'll see aliens land before that ever happens. It was designed to fleece money from suckers in a crypto scam. It's unbelievable how suckerbook marketplace turns a total blind eye to fraud. Almost all the sponsored ads on it are scammers.1 point

-

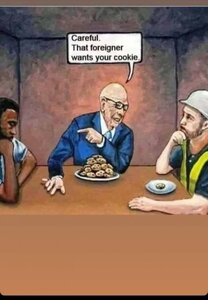

There's a lot of disinformation involving Pauline, a lot of it with AI altered photos or cut/paste, all of it showing her in a good light and Labor losing arguments with her. ABC Verify have traced it to some people in Vietnam. I reckon that meme above is one of them. https://www.abc.net.au/news/2026-03-11/foreign-fake-news-pauline-hanson-one-nation/1064367021 point

-

Different pollsters ask slightly different questions, but a lot of them lately seem to be polling primary intentions and not preference direction. Gender and age group is usually asked for analysis. A lot of it is probably swayed by immediate events. For example, in the latest morgan poll, the Greens have picked up 3% and Labor is down 4. Morgans think that 3% Green gain at Labor's expense is because of Albo and Co. going all the way with DJT and the Greens taking a stance against the US/Israel strikes. Some of the analysis is interesting. There's been a trend for a while now of the youngest age group, 18-24, moving more to the right. The Greens and Labor have lost support in that group to One Nation, independants and others, but the Greens have gained in all groups 25+, whereas Labor has lost in all age groups and both genders. One Nation gained support in all age groups under 65. Some polls a couple of weeks ago showed ON gaining among young women more than young men. A bit of a reverse from it's historical male dominated support. I think One Nation is the wild card, and come next election, they will have either fallen on their face or put egg on a lot of other faces. The Greens are what they are. What you see is what you'll always get, 10 to 12%. If Labor stuffs up enough, the Greens might get 15% briefly but they just don't appeal to enough of the population to acheive anything higher than balance of power in the Senate. Nev, you're right about the Nats/Libs being in big trouble. At the moment they are well and truly wedged. All Labor has to do is sit tight and win. Of the small amount of Labor primary votes bleeding to the Greens, most would return in preferences. Labor would feel a lot more comfortable having the Greens on the left than the Coalition would feel having One Nation on the right. It's like the Coalition has driven their Ford Ranger into a parking space designed for little noddy cars, and now they're stuck and can't get out. Go to the right, they lose the centre, go to the left and they lose the right. Interesting that the Nats have elected a Victorian moderate as deputy. More than likely for balance. Matt Canavan can talk the talk to try to woo voters back from One Nation, and Chester can try to butter up the Libs. Smoke and mirrors.1 point

-

The man is gone Jerry, but never will be forgotten. One of the great protest songs of our time. The words still ring true today, three decades later. Our current leaders looked weak and uncomfortable beside his brother at the recent Garma Festival.1 point

-

1 point

This leaderboard is set to Melbourne/GMT+11:00