-

Posts

8,368 -

Joined

-

Last visited

-

Days Won

70

Content Type

Profiles

Forums

Gallery

Downloads

Blogs

Events

Our Shop

Movies

Everything posted by Jerry_Atrick

-

Behind a paywall,but it looks like the Iranian women's soccer team have taken a like to Australia: https://www.theage.com.au/politics/federal/sos-hand-signal-as-bus-drives-iranian-women-s-soccer-team-from-final-match-20260309-p5o8mq.html

-

One if the issues is not the actual closure of the Hormuz Strait, but the unavailability of insurance. Most shipping is financed and every maritime finance agreement (usually leases) includes maintaining insurance as a covenant to the lease agreement. No insurance, no sailing - it is as simple as that.With the US rather stupidly torpedoing the Iranian warship, as far as Iran is concerned, if they weren't already, all bets are off. The other problem is most cargo/freight shipping is sold as futures contracts, which have specific terms and conditions. In theory, the freight has to be performed according to the standard terms and conditions, which I think includes route stipulation. So, if the route markedly changes, and it's really not profitable to reroute, under the standard terms, force majuere may be able to be invoked and the futures contract voided. If there is no force majuere clause, the shipper may have to reroute, but een then it can be an issue,because the freight contract will specify a time to deliver. In either case, the shipper may well go broke - or at leastdeclare bankruptcy. In the former case (lease agreement), two things happen. The lessor/s take control of the ship - which is an unusual occurence, or the lesee will moor the ship in a dangerous area (e.g. Somalia) and let the lessor/s know they can pick it up there (more often). This will take out shipping capacity. And with an absence of supply while demand goes high... and costs increase... frieght spot prices which are not subject to the same constraints as futures contracts will skurocket. Yeah, they can reroute and the supplies will take a week or two longer to get to where they are going, but you are going to pay for it.

-

Go with the flow

-

I understood your point. I don't think it adequtely addressed OTs. And, maybe I didn't make mione clear enough. There is a difference between baddies in a population of people, than the population systematically preaching bad. Yep, I am sure the crazy gunman who killed the 56 Muslims in Christchurch as a Christian. But he didn';t do it in the name of Christianity - and if he did - it was his delusion that Christianity these days promotes it. I don't see too many Christians wearing only one type of cloth these days and I don't see too many Christians stoning their fellows for doing it. Nor am I threatened for being an athiest, nor are those living in fear of being gay out of religious hatred, or if you are in the tragic position of being a woman who has been raped!. Now, go into some of the countries or regions where Islam is preached and see how long people of the above disposition would last - preciseley because of the religion. Yep, the MSM may inflame it, but it seems to tbe there. But hey, maybe spend time in these countries to affirm it. I spent some time in a moderate country, UAE (Abu Dhabi), and I can tell you, I will never, ever go back, so much so that all middle eastern countries are off my layover list travelling to Australia. And that is a moiderate country.

-

It's hard to react to that post.. Sad for Piastri.. But a Carltion loss is always sweet 🙂 Hawks flopped as well..just not so spectactularly...

-

He idolises smarties

-

As far as I am aware religion was not the core foundation and justification of Hitler, Franco, no Mussolini's barbarity. And even if it was, it is fair to say that as a vast majority, Christian faiths have modernised a bit and at least preach inclusivity and not that their God will kill infidels, etc. It may be that the press over egg it, but for some reason, there appears to be more of it under Islam than any other mainstream religion

-

Back to topic. This is an interesting report:

-

I am not into F1, but a mates son is in college doing engineering and has an placement on a scheme run by the F1 teams to bring on the next round of engineers. All he has wanted to do in his teenage years is work on F1 cars, so best of luck to him. I saw a headline on the Age' website quoting Piastri as sayingthe Mercs are just too quick.. Not sure in what context, but that doesn't bode well for McLarens. A bit of trivia.. My old home airport, Fairoaks, was right next to the McLarens Technology centre, where they did most oftheir F1 development:

-

Hasn't the ACCC warned servos and oil companies not to price gouge? Heaard someone on the radio day they are pretty much a toothless tiger, though I do remember them forcing Qantas, I think to refund fares over some scam of some sort. Over here, the prices are fairly stable. at the moment, which is a surprise. They usually jack it up straight away, and when the oil and gasoil prices settle back to normal levels, it allsort of takes a very long time for the retail price to retract and then no where near what it was.

-

Indeed! Reminded me of the first time SWMBO came out to Aus on holiday with me. We werein Melbourne and I decided to take her to Brown Brothers in Milawa. Sadly, she was not into flying in the big jets let alone a rented PA28, so it was to be by car. I told her we had to leave at 7am to get there by 12. She didn't believe me but went along with it anyway. not 2 hours into the trip, she was visibly frustrated, even though I still had what was a young VS commodire, which was comfy for those drives. By the time we got there, she was virtually a nervous wreck. "Who on the face of theis bloody earth travels that far by car just for lunch.. and how f@cking big is this counrty???" Then she went and ordered roo while I had beef. Guess who ended up eating roo? When we moved to Melbourne, she declined my offer of a drive to Mildura to have dinner at Stehano's.

-

How far away is the average shop or school or mates place in London urban areas? When you go across town to visit a mate and have a few drinks, public transport is byu far the best opton (unless they're on strike).

-

You have to watch it on YouTube as it contains adult language..

-

Most people I know are very happy with their hybrids.. but that is because it usually only uses the electric motor. They have someting that is a city or town runabout, and for that, they are just carrying a motor, fuel and a drivetrain they don't need. Theyt don't need to aqueeze every ounce of utility from the thing; It still carts the shopping and kuds around comfortably. I was speaking to someone that still has a Prius and he admitted the petrol in it is probably 5 years old - and there's not much of it.

-

Not for those of timid dispositions:

-

I don't think Down East is a troll and I welcome his perspective. His rebuke was based on fact. Yes, he went aggressive on it, but no one has so far disputed that fact. It is easy to blame the US for everything, but as I have mentioned on the What has Putin Done now feed, the Europeans also caved in.. The "insult", IMHO doesn't detract from his point, although I agree, we should purely play the ball and not the man. "That is complete crap".. would be better but remember, the US have different cultural norms and the term used, "you are full of it" is in context of what you have presented usually, and not a general aspersion (although, yes it cane be in certaincircumstances)- but that was predominiantly the west coast for me. East coast could be different. And I am sure some will say I am full of it now 🙂 You forgt the role the fourth pillar of government - the press - plays. The press today is increasingly partisan and and misleading in their approach, and this is the primary method of informihng the public, who are increasingly time pressed just keeping their heads above water - exactly as the politbureau want it, I would suspect. so... IMHO, is spot on and applies to others I can think of - ScoMo, BoJo, and even Putin when it was more ore less democratic in Russia for that very short window.

-

Help - How do I invest my childrens inheritence money

Jerry_Atrick replied to Admin's topic in General Discussion

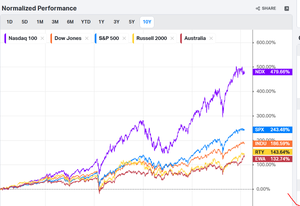

Hi Ian, My first thought is speak to a trusted financial advisor. $100K is probably not a lot for most of them, but importantly, your kids are young and this could be the kick start for them to invest to earn and not save. Yuor strategy with your bank savings did very well.. I am guessing it was compounded or sem compounded interest that was being paid (and by semi compounding, I mean left the interest payments paid on whatever frequency in the account to add to the principal on which the interest is being paid). I am no financial adviser, and if you look at my current personal financial position, you would probably want to do the opposite of what I have done, but FWIW, which is nothing really, when investing, you have to consider at least the following: Purpose and Time Horizon: In this case, you are saying they want to buy a house and at 27 and 24 repextively, I would say the time horizon to utilise the funds and any growth will be shorter than 10 years. Risk aversion: From the purpose, I would suggest there shouuld be a low tolerance to risk. In investing, like most other things, there is suaully a risk v reward gradient - the higher the risk, the exponentially higher the reward you should seek, because at anything greater than 10% risk, you should assume you will lose it. The timeframe is relatively short and the purpose is a major capital purchase. I would suggest a very low risk tolerance Strategy of investment: Do you want to max returns or ensure the amount preserves its purchasing power/value. We all think max the returns, but I would argue, with a low tolerance to risk, it is more about preservation/modest growth - i.e. safety rather than squeezing every drop yu can from it. That is my opinion, yours or your kids may be entirely differnt. Costs and Charges: Whatever you choose there's a cost, and an opportunity cost. What may seem a "small" charge (2%) is actually high and can cost you much more, especially over time. In the EU, all unit based investmen companies have to publish the effect of their costs on projected earnings versus the cost free projected returns and the graph differences are very telling. Also remember, for unit trusts and the like, there is often trailing comissions paid to agents for years - the life of the investment. But. don't be too stingy about it. If you are paying two percent and they are giving you a 20% return, bersus paying 0.5% for a 10% return, well, I would rather take the former. It's a minefield. Taxes, which is another cost at the end of the day. There are tax efficient vehicles in Australia for investments held over 10 years, but you generally always pay some. I would suggest a short term super fund investment is not the way to go as therewill be taxes and exit fees (ooh, I forgot to mention those earlier - they can be a bummer on unlisted funds). Australia has about the worst tax regime for personal investoers. Even the US has tax free investment accounts. In the UK and Europe, there are tax free accounts - UK has ISAs - up to £20K per year can be invested and returns are entirely tax free. Also, we pay zwero input tax into Super and 25% of contributions can be withdrawn tax free after 55 years of age. It sounds like you are pretty averse to risk, but also the time horizon and purpose would mean you would want more fo a defensive strategy than a aggresive one. The infation rate in Aus at the moment is 3.8%, so a 4% term deposit is treading water - sort of. If it is compounded daily, then it can grow very much quicker than inflation as the rate curve becomes exponential-ishh0. House price inflation in the areas your kids want to buy is more important - how can you invest and keep pace with that? Also, I read that Chalmers is considering a cap of two homes for negative gearing, and I am guessing the removal of the CGT allowance on residential property investors, which personally should have been done years ago and contributes far more to house price inflation than the immigration issue (which also does contribute). Also strengthening Anti Money Laundering riles for real estate agents and solicitors shouldl also have been done years ago. These measures will slow house price inflation, but it will still be more than the inflation rate. What that may mean though, is that they want to get on the housing ladder sooner rather than later, even with the changes. I am sure there are other consisderations than the above.. Personally, an ETF that has a mix of growth hedged by defensive positions would be where I would go for. While it is very low cost here, and online brokers don't charge a fee (they get a 0.05% commission, generally), they tend to perform to the market. Despite the market turmoil, over the last 10 years, the NDX (Nasdaq top 100, I think) has performed remarkably: But note, while over the longer term, index finds do well, there is a lot of short term volatility and they may slump right when you want to cash in. There are other options than the financial markets. Despite the potential cap on negative gearing and the CGT allowance changes that may be coming, it may be worth them pooling their cash and earnings and investing in property rentals. Also, not necessarily residential. Quality commerical stuff such as medical centres, etc on maintaining leases are great and you would be surprised how you can access finance to this stuff. But also residential investments will help combat house price inflation and they can use the increase in equity over time (especially if they make improvements that add value) as collateral to expand their portfolio, and in 10 years they may have enough being generated from a portfolio to afford them each a house and some passive income to boot. The long and short of it is that they have to look at their life aims (maybe not focus on using the money to buy a house but set themselves up spo they can buy a house if that makes sense), do their research and look beyond the traditional financial markets investing . Hope that helps a bit -

Well, those countries that are bound are also bound to arrest someone who is charged or wanted for an international war crime if that person steps in their country. Would be interesting to see a charge brought against Chump and he then visit (pick any country) and see if that country would arrest him. Even Net may pose a problem for them.

-

That does not alter the fact that the are asked by others to put their shovel on those other's ship. How goo that shovel is or how they use it is a different question altogether. Still, compared to the alternatives,despite their drawbacks, I would rather the US anyday. Maybe we have been fortunate to be on their good side. Yep.. and at the same time appealed to the US as well to force assistance through.. In addition, when you appealed to the UN for military assistance, you are really appealing to the US as they would be the only ones to take the lead. That is my point.. they saw the US as their defender, and they kept asking the US for help. Again, asking the US to put he US shovel in their ship. Agreed.. again the Kuwaitis made direct pleas to the US as well as the UN... I sort of see a pattern here. That may be true - but in the Syrian civil war, the Syrian opposition groups made direct representation to the US for military help. Others want them to weild that shovel. Just as in Iran, opposition proxies also called for help.

-

WTF am I talking about? Well, yeah, I got the Airbus thing wrong as before them, Europe relied on the US (and lately, I see US tankers refuelling European aircraft.. so not sure why). But the rest? Are you saying that is all BS? Yeah, Biden, who did live up to his nickname of sleeepy Joe when it came to Ukraine vetoed jets and other equipment. But Ukraine. a European country, still did ask for help - and still got over $20Bn of direct support from the USA. And finally, but too late, did get some old jets allowed to be transferred to them. Or did that minor fact - and the rest of the post get missed?

-

We're lucky here, too. Our first foray into regional life was not the best. We took 12.75 acres between a hamlet and a village. I don't think I ever saw anyone from the hamlet in the 3 years we were there. Through the kids school, we knew and got on well with the patriarchal farming family in the village, but somehow never felt welcome or fit in. So we sold uo to a large farmer from West Sussex who was looking to downgrade in retirement. They lasted the same amount of time and despite putting a lot into the community (they were retired, after all), also felt they were not welcome. As it turns out these small inter-generational farming villages are social fortresses and newbies take a very long time before the are welcomed. Our next move to rural village life was between the village my partner mostly grew up in - a tight knit intergenerational farming village, and where we are now. We visited the village occasionally after we moved here and SWMBO caught up with old friends. We looked at a property there ready made (i.e. not a bit of work needed) and this one, which we are still finishing. I noticed that while those that were left in the village (a lot moved out and visited for festivals and gatherings) were friendly enough, they weren't warm in ther welcomes. They were more interested in catching up to compare lives than rekindling any serious friendships. We selected this village, which although about the same size, is not an intergenerational farming village, and has a good mix of local and newbies. We also knew two families from the kids schools and we got on with them well. The day we moved the furniture in, we were stuffed and had dinner at the village pub. The villagers were warm. welcoming and basically said they are very happy for us to be there and intergrate with the village or live our own lives. We chose the former and it has been an excellent experience. Yep, there is the village politics, which can be downright entertaining, and despite there being some grudges between people, it is generally an excellent vibe. It is also a good mix of young families and retirees. I am in a real quandry. We are getting closer to selling and moving on.. I am not sure I want to sell, as it owuld be good to have a long distance bolt hole. Or, if for some reason, Australia doesn't pan out.

-

I didn't say European, I said northern hemisphere. And the support of America does not necessarily mean boots on teh ground, does it? Haven't seen US boots on the ground in Iran yet. But since you ask, European, none. But no European nation can air to air refuel without the USA. Most of the weapons systems.. provided by the USA (though that is now changing). Where would NATO be, and the defence against the cold war without the USA? You could argue with the USA bases through Europe, there were boots on the ground to prevent a real war. No? And here are a few that may be unpalatable, but were at the bequest of the respective government, as I understand. Happy to be proven wrong: Korean war - at the request of the South Korea Vietnam War - at the request of the South Vietnam Gulf War - at the request of the Kuwaitis. Syrian civil war - not by Syria of course, but by those that were part of Operation Inherent Resolve Although no boots on the ground, Ukraine - which is part of Europe (and now being criticsed for saying its a European thing to solve - and of course, appeasing if not siding with Pootin) Outside the northern hemisphere, Taiwan relies heavily on USA for its sovereignty. Australia relies heavily on US miltirary equipment (can we air to air refuel??). And AUKUS is payback, I guess.

-

Sadly, a good old fashioned shoot=em-up war will grab the headlines. The Epstein files saga is a disgrace and shows just how much the swamp will go to protect itself - regardless of political colour. Of course, in their position, I doubt there are many of us that would go to war for it, but we would use whatever other means at our disposal (short of violence, I hope) to protect ourselves, too. # But, I guess you have to be of certain character to even be entertained by the likes of Epstein, let alone need to worry about defending oneself after the fact. The saga reminds of when I entered banking. I took a job with a bank that was embroiled in various misconduc scandals (before I joined, I hasten to add); and even when succumbing to billion dollar + fines from the Fed, still engaged in one last hurrah of misconduct (which kept me gainfully employed for some time at other banks who did the same). When public pressure was impressed on them (as they had taken loans from the Bank of England), the executive team came up with 5 golden question of conduct, which if followed, and largely were to be fair, meant they would be a much better bank for it. I can't remember the first 4, but they were largely around would you do this to your loved ones type questions. The last though always resonated with me, and it was something like, "If what you are doing went public, would you be able to hold your head high in good conscience in 5 years time?".. It was better worded. If people lived thir lives trying to answer yes, the world would be a better place - but only based on the individuals moral and values compass. For example, stoning gays and I believe is some cases, women who are raped, to death in some countries is perfectly acceptable and respectable. And to be honest, if that is the case, then they will have lived their lives according to their cultural and societal values, regardless of what other societies think. I should point out, I condemn such action myself, but I am making an observation. Sadly, I haven't always passed the test, but jeepers, there are a lot worse than me, by the looks. And they will do anything to cover it up.